Bookkeeping Service

Expand Your Business, And Leave The Bookkeeping To Us!

The long-term health of a business depends on accurate bookkeeping. Wire IT Solutions delivers a broad range of industries and consumers, from self-employed home-based business owners to small and medium-sized organizations with workers. They are experienced, cheap, and reliable; therefore, you will receive personalized assistance and state-of-the-art consultations if you choose them for your bookkeeping needs.

If you are starting your business, it will install reporting and bookkeeping tools to make it easier to keep track of your finances. If you have been in business for a while but need some help organizing and cleaning your books, it will work for you to optimize your bookkeeping and create a system of checking and balances.

The best factor about hiring bookkeeping services is that you will have more time to focus on the company’s operations and strategy and to generate more profits. Whether in your office or with them, it creates a workspace for accounting duties and bookkeeping services. They start by understanding your unique needs and only educate consumers on a statutory and customary ledger and manage rules during face-to-face meetings.

It can keep track of payments and receivables, invoices, disbursements and bills, and withdrawals. So, why do you bother with the usual bookkeeping services when you can delegate time-consuming tasks to them? You will save your time and effort. Their team stays updated on the most recent accounting standards and legal requirements. Thus, it simplifies your complex tax calculations and payroll administration, among many more bookkeeping services.

FAQs

Sometimes Bookkeeping and Accounting are used interchangeably. Although Bookkeeping and Accounting are inseparable, there is a thin line to differentiate between them. Bookkeeping is a component of Accounting, and Accounting has a wider scope than Bookkeeping.

Bookkeeping:

Bookkeeping maintains and records every financial transaction in the basic books of entry. Bookkeeping involves summarizing and organizing every company's financial transactions in a chronologically organized manner.

Bookkeeping focuses on the daily financial activities and transactions of a business. Bookkeepers manage and record books of account. Every financial transaction like payment of taxes, loans, payroll, sales revenue, interest income, other operating expenses, investments, etc., is recorded in the basic books of accounts.

The books of account need to be updated as it is the basis of accounting. The accuracy of Bookkeeping determines the accuracy of a business's post-accounting process.

Accounting:

Accounting is the process of analyzing, summarizing, interpreting, and reporting the financial transactions of a business. Financial statements made in accounting accurately summarize financial transactions in accounting time. These statements summarize the company's financial situation, process, and cash flows.

Accounting consolidates financial data information to make it more understandable and clear to every stakeholder. It will help businesses to manage timely and accurate records of their finances.

The accountant manages and compiles a company's day-to-day transaction records in financial statements like income statements, statements of cash flows, and balance sheets. Financial statements will help to evaluate the company's performance by every stakeholder.

Bookkeeping is the work concerned with recording financial data information relating to business operations significantly and systematically. It covers every procedural aspect of accounting work and adopts the function of record keeping. There are different types of bookkeeping practiced in controlling the books of accounts.

Types of Bookkeeping system

A single-entry and double-entry bookkeeping are two commonly used methods. While each has its advantages and disadvantages, businesses have to select the one that best suits their business.

Single Entry Bookkeeping System

- The single entry system requires one entry to be recorded for each financial activity or transaction.

- Single-entry bookkeeping is a basic method a company may use to record day-to-day receivables or generate daily or weekly reports of cash flows.

Double Entry Bookkeeping System

- The double entry system requires a double entry for every financial transaction.

- The double entry system gives checks and balances by recording the corresponding credit entry for every debit entry.

- The double entry system isn't cash-based. Transactions are recorded when there is a debt or revenue is earned.

FREE CONSULTATION

CONTACT US

- 1900 N Bayshore Drive, Miami, FL 33132

- 8774690296

- info@wire-itsolutions.com

LATEST POSTS

-

df350f926bc78c034c00d4c5b159333e

June 21, 2023 -

df350f926bc78c034c00d4c5b159333e

June 21, 2023 -

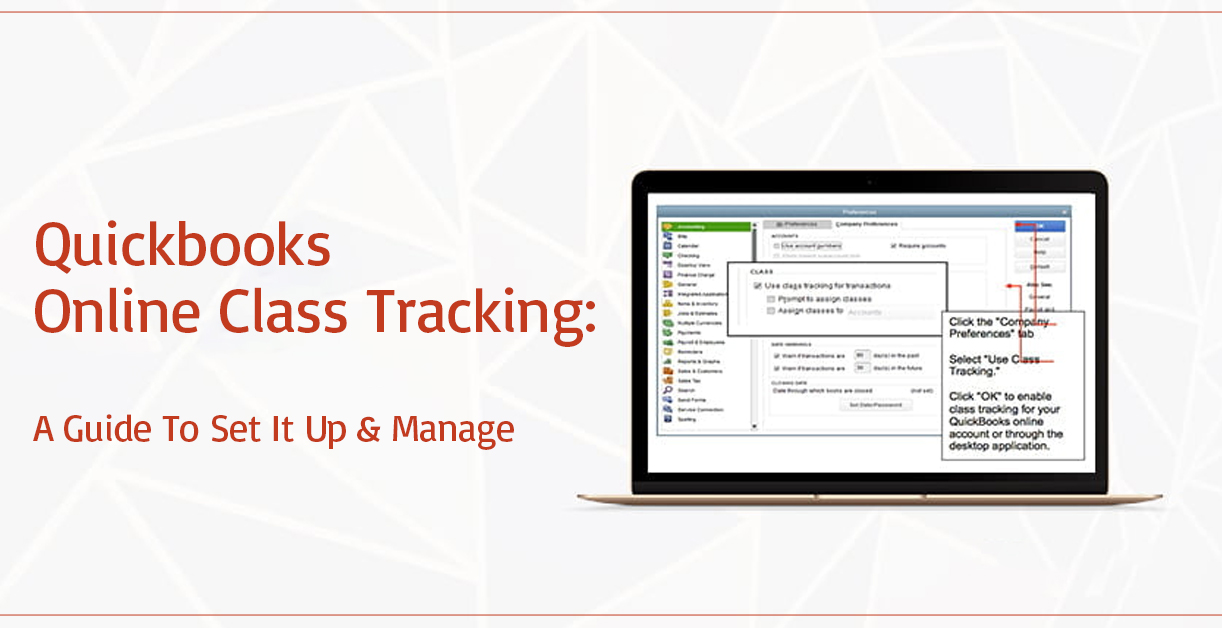

QuickBooks Online Class Tracking: A Step-By-Step Guide To Using It

June 4, 2022 -

QuickBooks Mac Download: A Guide For The Accounting Software

June 2, 2022 -

QuickBooks Contractor Edition: Pricing, Features & Review

May 31, 2022