IRS Form 4852 TurboTax is a substitute for Form W-2 or Form 1099-R. You can attach it to Form 1040, 1040-SR, and 1040-X. It would be best if you attempted to get your form W-2, W-2c, and 1099-R from your employer. You will have to provide your employer’s name, address, and contact number. You may use form 4852 to file your return. Fill out form 4852 if the IRS does not send the required form. You can fill out form 4852 if:

- Your employer has issued an incorrect W-2

- You have not received a W-2.

The article will provide your information on filing substitute form 4852 on TurboTax. Please go through the entire article to know more about How to fill it, How to import W-2 in TurboTax online, request wage & income transcript, the purpose of the form 4852, Penalties, Specific instructions, required information, tips, and warnings.

Form 4852 TurboTax- How To Fill It?

You can file a tax return that includes IRS form 4852 to obtain a W-2 from your employer. Follow these simple steps to fill out form 4852 in TurboTax-

- Firstly, open your Return section

- Secondly, click on the Search icon and type W-2

- Then, press the Enter key on your keyboard

- Select the Jump to link to get the W-2 entry screen

- Fill out the information from your last pay stub

- After that, answer the on-screen questions

- Then, navigate to the Uncommon Situation Screen

- Tick the checkbox next to the Did not get a W-2 box

- Then, click on the Continue option to proceed

- Select the Yes option and tap Continue to move ahead

- After that, answer the follow-up questions

- Finally, select the Print option to download or print the IRS form 4852 on TurboTax.

Form 4852 TurboTax- Import W-2 In TurboTax Online

You can usually import W-2 directly from over a million employers. Follow the instructions mentioned below-

- Firstly, click on the Sign-in option

- Secondly, go to the Return section and tap the Search icon

- Enter W-2 in the text field and press the Enter key

- Then, select the Jump To link to proceed further

- After that, click on the Work on my W-2 tab to proceed

- Tap the Continue option or choose the Add another W-2 tab

- After that, enter your EIN in the box-b

- Then, answer the security question on your screen

- Click on the Import option to proceed

- Finally, import your TurboTax

If TurboTax Online does not support your EIN, you can print the form 4852 TurboTax; you can use the screenshot or print feature to save the TurboTax form.

Read More:- Error 65535 TurboTax: An Ultimate Guide To Fix It

How To File Form 4852 TurboTax With Your Tax Return

TurboTax Online asks a few questions to determine the required details from your final pay stub. You need to fill out form 4852. The Internal Revenue Service does not allow anyone to submit it electronically. As a result, you need to print out the form and mail it to the IRS.

The IRS may take more time to process your tax return because the IRS verifies your information. It also provides you with a few additional months to file your return. You can also request an extension if you do not mind waiting.

Request Wage And Income Transcript

If you want to verify the provided information, you can request a Wage and Income Transcript through the Internal Revenue Service. The data includes additional information on your returns.

- Request Wage and Income Transcript online

- Use the form 4506-T

- Compile all your information

- Order it before the tax deadline

- Compare your provided information

- Fulfill your wage & withholding information.

Form 4852 TurboTax- Purpose Of The Form

IRS form 4852 on TurboTax is a substitute form for the 1099-R, W-2, and W-2c. You or your representative can complete the form fill-up process. Provide your name, address, contact details, date of employment, and social security number. Internal revenue service will contact your employer to request the missing form. If you did not receive the missing form, then the IRS might send you a Form 4852 to file your income tax return timely.

Form 4852 TurboTax- Penalties

The Internal Revenue Service challenges the individual’s claims to avoid federal tax liability. If you use the IRS form 4852 for improper use, then the penalties are-

- 20% of the actual tax amount if there are any accuracy-related penalties

- 75% of the exact tax amount if there are any Civil fraud penalties

- If you file a frivolous return, then a $5000 civil penalty.

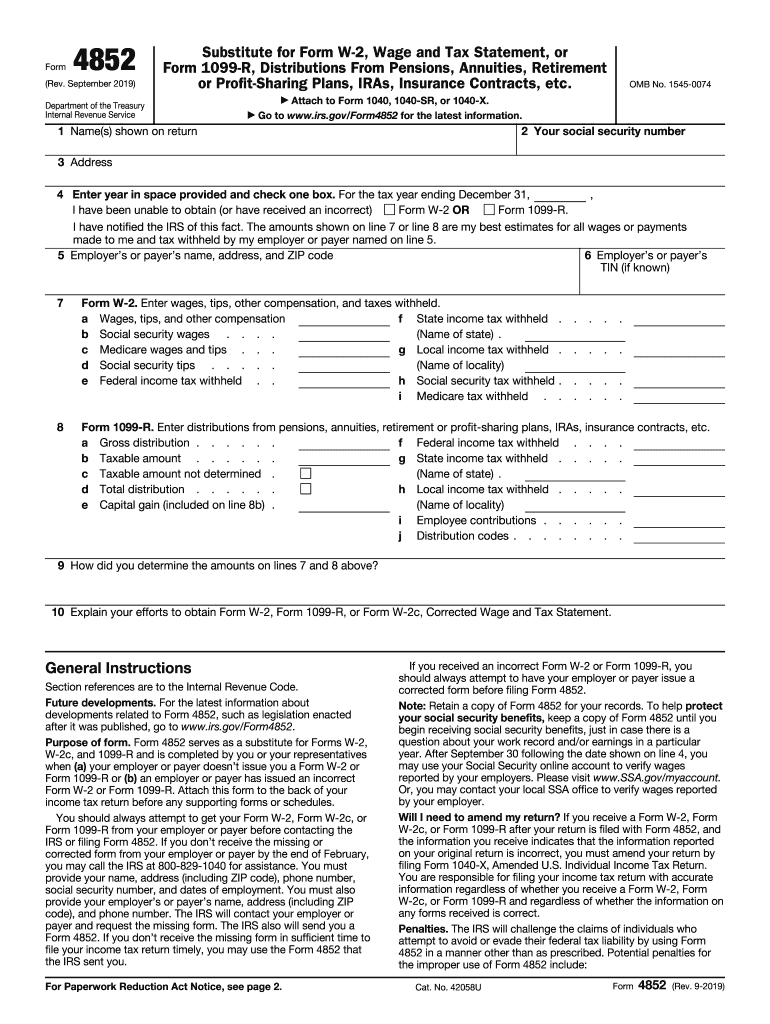

Form 4852 TurboTax- Specific Instructions

Here are the specific instructions to fill out IRS form 4852:

Line 1 to Line 3

Fill out your name and current address with city, state, zip code, and social security number.

Line 4

Type your year which you did not receive the form or incorrect.

Line 5

Enter the employer’s name, address, and zip code.

Line 6

Provide your TIN (taxpayer identification number), EIN (employer identification number), and other details.

Line 7

Fill out the correct information by using the final pay stub. The report includes:

- Wages or compensation.

- Social security wages.

- Medicare wages.

- Federal income tax.

- State income tax.

- Local income tax.

- Social security tax.

- Medicare tax.

Line 8

It includes Gross distribution, Taxable amount, Total distribution, Federal income tax, State income tax, local income tax, employee contributions, and distribution codes.

Form 4852 TurboTax- Required Information

You need to provide the following information:

- Name

- Current Address

- SSN or Social Security Number

- Employment Date

- Distributions

- Employer’s name, address, and phone number

- Employer’s ID

- Other Identifiable Information

- Mention how often you contacted the IRS and when.

Why Should You File Form 4852 On TurboTax

Keep IRS form 4852 for your records to verify the earnings. You can use it as employment verification and proof of income. You may also need to file an amended tax return for form 1040.

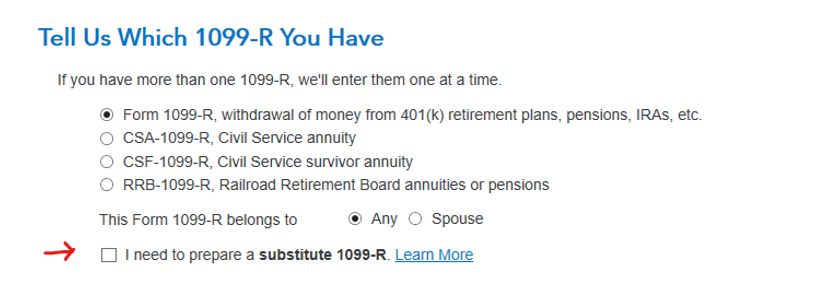

File A Substitute 1099-R using Form 4852 On TurboTax

Here are the instructions to file a substitute 1099-R using the form 4852 on TurboTax-

- Firstly, launch the TurboTax Deluxe Windows

- After that, go to the Open Returns page

- Then, click on the View option to continue

- Select the View Forms option to go to the Forms mode

- After that, click on the Search icon or search field

- Type 4852 in the text field and press the Enter key

- Then, select Form 4852 from the search results

- After that, follow the on-page directions

- Finally, enter the form 1099-R information.

Form 4852 TurboTax- Tips & Warnings

Here are the Tips & Warning for the form 4852 TurboTax-

- Firstly, try to get your Form W-2

- After that, make a copy of form 4852

- Penalties for the misuse of form 4852

- Wrong information will lead you to the penalties

- Most Importantly, follow the IRS instructions

- Finally, please review the form before submitting it.

Conclusion

The above article includes information about Filling Form 4852 TurboTax, tips, warnings, Penalties, import W-2 in TurboTax online, the purpose of form 4852, request wage & income transcript, Specific instructions, required information.

Wire-it Solutions offers individual tax preparation and tax filing services. Consult our experts for proper assistance if you are stuck on any process. Please post your queries in the comment section below to solve them immediately.