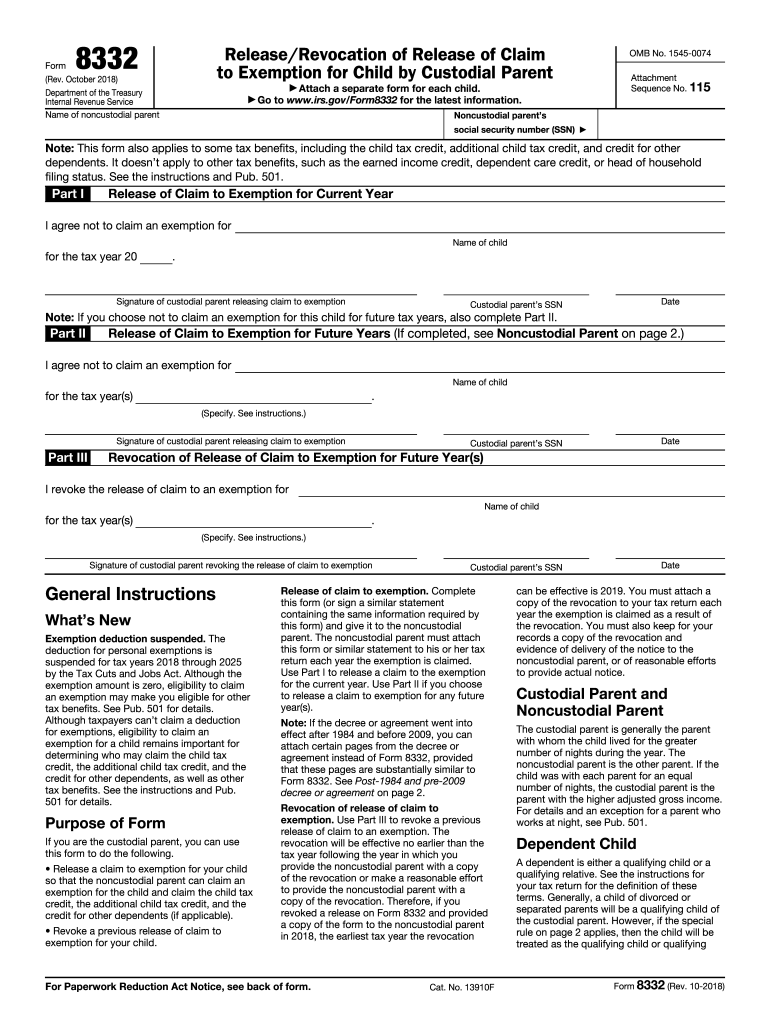

Form 8332 TurboTax is for a parent who holds a full-custody child and wishes to claim their tax return. The IRS form 8332 requires minimal information, and it grants your ex-spouse to claim your child legally. You can fill out the form for single or multiple years. However, if you have filled out form 8332 for numerous years, skip part 1 and complete part 2.

The formal name of form 8332 TurboTax is Release of Claim to Exemption for a child by the custodial parents. It lets you claim the exemption and if you are a noncustodial parent; the IRS allows you to fill form 8332 in the tax return for single or multiple years.

The blog also includes filing form 8332 electronically, required information, the E-Sign process, and tax benefits. You can attach the IRS form 8332 to form 8453.

IRS Form 8332 TurboTax- Required Information

The IRS had permitted the divorce decrees or separation agreements to substitute the IRS form 8332 TurboTax for a long time, but it is no longer allowed now.

Form 8332 TurboTax is simple to fill out. You will also need the following details to finalize the form:

- Social Security Number

- Signature

- Tax Year

- Name of your child

- Parents SSN or Social Security Number.

The IRS (Internal Revenue Service) may perform an audit if you are a noncustodial parent and claim the child in your tax returns.

IRS Form 8332 TurboTax- Tips To Remember

Here are the five simple tips to remember when filing the IRS form 8332 on your TurboTax program-

- Save your time by filling out part 2 of form 8332, if you are filing it for multiple years

- If you are filing it for a single year, then fill out part 1

- Do not claim your dependents without the form 8332

- Complete part 3 of IRS form 8332 on TurboTax if you released the dependent claims ago but wants to take them back

- If you are a noncustodial parent, you need to provide half of the financial support to qualify.

Read More:- Form 7202 TurboTax: Guide To File It & Specific Instructions

IRS Form 8332 TurboTax- Steps To Make e-sign

Here are the step-by-step instructions to eSign the form 8332-

- Firstly, launch the TurboTax program or browser

- Secondly, visit the TurboTax official site

- After that, click on your document

- Choose the Upload option to proceed further

- Then, choose the My Signature option

- Select the type of your e-Signature from the list

- Typed Signature

- Drawn Signature

- Uploaded Signature

- After that, create your e-Signature

- Then, tap the OK option to save the signature

- Finally, press the Done tab to complete the E-Sign process.

After e-signing your IRS form 8332, you can download your tax form and send it over mail.

Steps To Get The Form 8332 TurboTax

Go through these instructions to find and fill out form 8332-

- Firstly, open Your Return in TurboTax program

- Secondly, click the Search icon and enter form 8332 in the text field

- After that, hit the Enter key or tap the Search icon

- Click on the IRS form 8332 from the search results

- Then, tap the Yes option to continue further

- Follow the on-screen commands and fill out the required details

- After that, ensure that you have entered all the facts correctly

- Finally, finalize the tax filing process.

How To File Form 8332 Electronically?

Here is the description of how to file form 8332 Electronically-

- Firstly, you must file the IRS form 8332 with form 8453

- Secondly, only check the box on form 8453

- Complete the other government forms that need to be attached with the IRS form

- Then, mail these documents to the Internal Revenue Service

- After that, attach the form 8332 electronically

- Then, open the form and select the Electronic filing option

- Choose the miscellaneous options and prosper notes from the menu

- After that, fill out the required details

- Then, enter “Y” to confirm your changes and save the settings

- Finally, calculate the return.

IRS Form 8332 TurboTax- Custodial Parents

If you are one of the custodial parents and want to release the dependency claim to the noncustodial parent, you must fill out IRS form 8332. After filling out the required details like date, name, social security number, signature, etc., you must hand form 8332 to the noncustodial parent.

The noncustodial parents will also have to file it with their tax return. If you release the claim for multiple years, other parents will have to attach copies of the original form 8332 each year.

Custodial parents can claim-

- Child Care Credit

- Earned Income Credit

- Head Of Household.

IRS Form 8332 TurboTax- Noncustodial Parents

The noncustodial parents must be eligible to claim the child as a dependent. Here are a few rules:

- Parents should live with their children for more than six months of the year

- Divorced or Separated parents can waive off from the above rule

- Support your child with 50% of the yearly support

- Noncustodial parents should live more than half a year.

The noncustodial parents can claim-

- The Child Tax Credit

- The Exemption.

IRS Form 8332 TurboTax- Claim Back Your Child Dependency

You can claim your child as a dependent again by completing part 3 of IRS form 8332. You can also do it for all future years or a specific year. The taxpayer just needs to fill out the required part of your form.

IRS Form 8332 TurboTax- Tax Benefits

The IRS form 8332 TurboTax applies to several tax benefits. Here is the list of included & excluded tax benefits-

| Includes | Excludes |

| Child Tax Credits | Earned Income Credit |

| Additional Child Tax Credit | Child & Dependent Care Credit |

| Credit for other dependents | Head Of Household filing status |

Conclusion

IRS or Internal Revenue Service always enables you to relinquish your dependency rights with the help of form 8332. The IRS form 8332 TurboTax allows you to transfer the dependency status to your ex-spouse. You can do it for one or multiple years. You can also consult our experts to save a lot of time and money.

Wire IT Solutions also offers accounting services, software support, and bookkeeping services to let you grow your business rapidly. If you have any queries about the TurboTax form, you can comment down your question, and we will also provide you with a solution as soon as possible.