QuickBooks accounting software is recommended to various business owners. The QuickBooks taxes features allow you to generate reports and work with the accountant. You will also get automation, analytics, inventory management, and other accounting features. The IRS changes the tax filing system every year. It might be complete or minor modifications to the tax programs. Moreover, QuickBooks lets you know about these changes and their effects.

QuickBooks accounting software makes you prepared and well organized. As a result, the taxation process will be easy and secure. In this article, you will get the instructions related to tax preparations, the use of QuickBooks taxes, and required reports.

General Tips For QuickBooks Taxes

You must prepare the financial records for easy tax preparation. Moreover, QuickBooks Taxes includes Audits, Tax Receipts, Receivables, and cash flow calculations. Here are a few tips to improve efficiency and minimize stress.

Why Should You Use Accounting Software For Your Taxes?

You must start using accounting software like QuickBooks as soon as possible. This software also offers excellent functionality in exchange for a relatively small cost. Every software includes Invoicing, Billing, Mobile access, Analytics, Reports, Payroll & inventory management. Moreover, each tool is a time-saver in the business management process.

QuickBooks Taxes software is easy to use and offers several features. The accounting software reduces financial errors. It also offers better product management and customer service. You will not get any integrity or security problems.

Read More:- QuickBooks Form 941: Learn About Quarterly Federal Tax Return

Use The Latest Changes & Deductions

Taxes laws and other adjustments may be helpful to save your money and time. IRS also tries to help SMEs grow and improve their financials. Work with an accountant to get the maximum deductions. You must use startup, home office work, business car costs privileges.

You can also set up retirement funds to save QuickBooks taxes. The IRS does not charge you when contributing any amount to your tax retirement fund. But, you will have to pay taxes if you withdraw that money.

Start Preparation From The Start Of The Year

The taxation season does not start in March. You need to start the preparation from the end of your previous season. It also allows you to track all your expenses. You can also maintain a diary. In short, it is crucial to managing records on time. It will also save a lot of time and effort.

Moreover, you can make notes about each business expense. Also, note down how it is related to your business. This is a valuable piece of information while filing taxes.

Important QuickBooks Taxes Reports To File Your Taxes

You can use the QuickBooks taxes reports to help you identify the financial and accounting activities. It also helps you track down your transactions precisely. Here are a few QuickBooks tax reports that you will need to file your federal or state taxes.

QuickBooks Financial Reports

QuickBooks accounting software delivers you QuickBooks Taxes reports. It helps you to track your company’s financial position. These reports are beneficial during the tax season.

You can use the Profit & Loss reports from QuickBooks to get an overview of your business. It makes your tax filing simpler. The report also lists all transactions during the selected period. As a result, you can quickly determine the revenues & expenses. It also lets you compare the expenses and income from the previous year.

The income & expenses report lets you track down the gross profit from each customer. In short, the QuickBooks Taxes report will also deliver an excellent & efficient tax filing experience.

QuickBooks Sales Reports

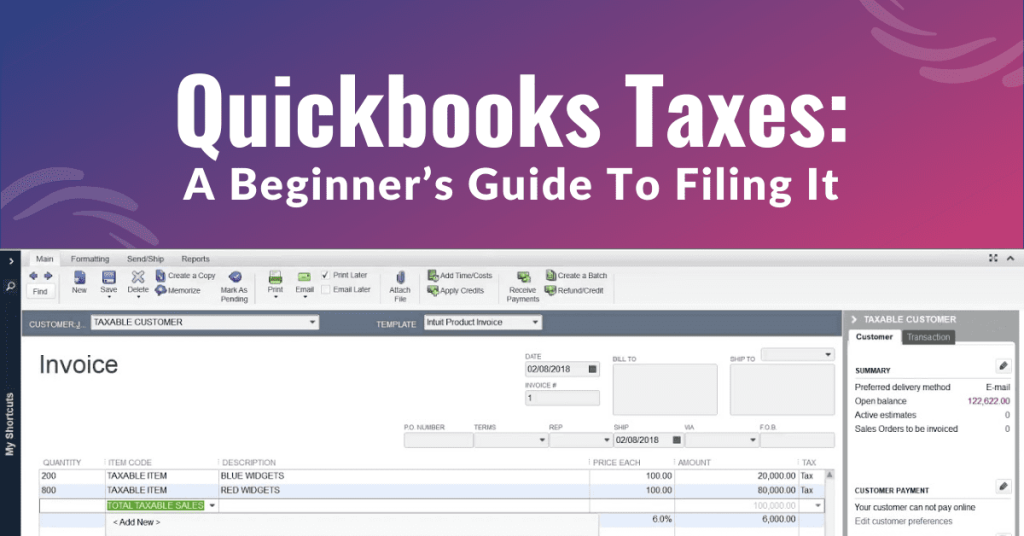

The QuickBooks accounting process includes bills and sales reports. You can use it to get better insights into representative sales, customer sales, and invoices. You can edit, calculate, and monitor due taxes.

QuickBooks Vendors Reports

QuickBooks Taxes offer Vendors & Payables reports to get the sales taxes summary. You can also use it to know what amount you owe to your tax agencies. It includes:

- Sales Summary

- Tax Revenue

- Sales Tax Liability.

Employee And Payroll Reports

QuickBooks Taxes reports are essential for payroll employees to track and verify their expenses. The report includes payroll details, employee leaves, vacations, financial data, and tax filings. The following reports will help to file wages management, employee management, and tax forms:

- Retirement Plan

- Payroll Cost & Taxes

- Compensation

- Wages Summary

- Payroll Tax Payment & Liability.

Service Tax Report

You need to pay service tax at most transactions. Moreover, QuickBooks has a tool to create different service tax reports, and here is the list of some of them:

- Service Tax Reverse Charge

- Service Tax Abatement Report.

Final Words

Customize your reports to meet the business requirements. You can use all of your company data in QuickBooks Taxes reports. You can also export all of your data quickly. Call our experts if you face any error code when using the QuickBooks accounting software. The experienced and trained experts will help you fix the issue on your device. Wire IT Solutions offers advanced accounting services and software support for individuals & small business owners.

Frequently Asked Questions

Payroll taxes are divided into three categories in QuickBooks taxes:

- Taxes paid by Employees

- Taxes paid by Employers

- Paid by both employer & employee

Follow these simple steps to pay your QuickBooks Payroll Taxes:

- Firstly, go to the QuickBooks Online homepage.

- After that, navigate to the Taxes tab.

- Select the Payroll Tax Center option.

- After that, select the e-file option from the menu.

- Then, tap on the Edit option to proceed.

- Moreover, select your State and follow the on-screen prompts.

- Finally, file your Payroll taxes in QuickBooks Online.

You will need these QuickBooks reports to file your taxes:

- Profit & Loss reports

- Income & Expenses reports

- Sales reports

- Sales tax liability report

- Payroll tax liability

- Sales tax revenue report

- Sales summary

- Payroll tax payment

- Wages summary

- Compensation & payroll cost

- Retirement plans.