IRS form 8949 TurboTax records your sales or exchanges of capital assets. Form 8949 on TurboTax is automatically generated whenever you enter the stock sales reports (sale or disposition of capital assets) on form 1099-B. The form is divided into two parts. The first part shows short-term transactions, and the second includes long-term transactions. TurboTax online automatically fills out the IRS form 8949 when entering the sales or exchanges data. After that, TurboTax will transfer all the required information to Schedule D. You will not need to fill out the IRS form 8949 yourself.

You can successfully use form 8949 in the TurboTax Live Self Employed, TurboTax Self Employed, TurboTax Love Premiere, TurboTax Premier, and Mobile application. TurboTax covers your rental property income, cryptocurrency, ETFs, Bond, stocks, and other investments.

Steps To Enter Form 1099-B In TurboTax Online

Here are the steps to enter form 1099-B-

- Firstly, open your return in TurboTax Online

- Secondly, sign in to your TurboTax account

- Click on the Take me to my return tab

- Select the drop-down arrow button next to the Tax Tools option

- After that, tap Tools to continue

- Select the Topic Search option from the pop-up window

- Then, type 1099-B in the text field

- Select the Form 1099-B option from the results box

- Click on the Go option to proceed

- Tap the Yes option in the next window

- After that, follow the on-screen instructions

- Enter your personal information in the required field

- Finally, import it to finish the process.

Form 8949 TurboTax- Get Your Total Gain Or Loss Amounts

You can get your total gain or loss amount by entering the details or importing the information-

Enter Total Gain Or Loss Data

TurboTax Online allows you to fill out Form 8949, and you can easily import up to 1500 transactions. If you want to import more than 1500 transactions, then-

- Firstly, enter or import Summary Transactions into the program

- Then, attach transaction statements

- Enter a summary for each sales category

- After that, type your total loss or gain amount

- Enter your gain as a sales price of 0

- Finally, enter the loss as the cost with a sales price of 0.

Import Total Gain Or Loss Data

Follow these steps to import the total gain or loss data-

- Firstly, open the TurboTax program on your device

- After that, go to the Summary tab

- Select the Summary of each sales category option

- Finally, follow the on-screen instructions.

Read More:- TurboTax Error Code 1719 (7 Methods To Troubleshoot It)

Form 8949 TurboTax- Attach Required Statements

Get your transaction details by downloading the statements. Follow these simple steps to attach your tax returns-

Electronic Filing

Go through these simple steps to attach the statements automatically-

If You Imported Your Total Gain Or Loss Data

Go through these steps-

- Firstly, enter the Tax Document Number & Password

- Select the Get My Form button

- Wait for a few seconds and tap the Continue option

- After that, select Add More Sales option

- Click on the I will type myself button

- Fill out the details and click Continue

- Then, select the Enter sales section totals

- Keep hitting the Continue button until you get the Browse button

- Drag & drop the files in your box

- Finally, tap Upload to upload the files.

If You entered Your Total Gain Or Loss Data-

Follow these simple steps-

- Generate the IRS Form 8949 & Schedule D

- Attach it to your tax return.

Paper Filing

Go through these steps to mail in the paper statement-

- Firstly, look out your Schedule D application

- Secondly, make sure that you have generated the total amount

- Remove the Schedule D and IRS form 8949 from your TurboTax account

- Finally, replace them with statements.

IRS Form 8949 TurboTax- Enter Total Amount

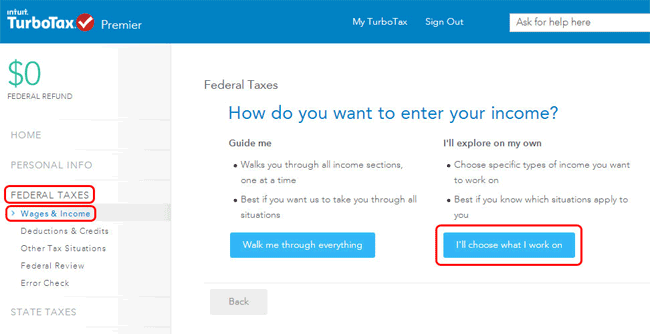

Here are the instructions to fill out form 8949 along with form 8453 by using the TurboTax Premier version. Here are the instructions-

- Firstly, you can not enter an amount of more than $9999999.99

- Break your amounts into multiple sections

- Enter the total of all lines

- Generate the IRS form 8949 on TurboTax

- After that, print the IRS form

- Read out the Capital gains & losses instruction sheet

- Create a new account or sign in to your old TurboTax account

- Click on the Federal tab and tap the Wages & Income

- Select the Let’s Get Started option

- Follow the on-screen prompts and select your details

- After that, tap Continue to proceed

- Go to the Wages & Income page

- Select the Start button and match your income

- Click on the Add more income tab to enter your income details

- Click the Yes button on your next screen

- Choose your investment type and tap Continue

- Then, import your tax info and click Continue

- Tap Sales section totals and select Continue to proceed

- Finally, fill out the required details in the form 8949 TurboTax.

IRS Form 8949 TurboTax- Error Code Message

There are multiple types of error codes that you may receive during the TurboTax program. Some of the standard error messages are-

- We looked but could not find any data in your file

- We tried but could not get any info from your file

- It looks like your CSV file is missing some information.

You should consider these rules while filling out the IRS form 8949 on TurboTax-

- Filename must contain TurboTax

- Unzip the downloaded file before using them. Otherwise, TurboTax will assume them black

- Do not edit or open the provided file

- Do not change the file type or format.

IRS Form 8949 TurboTax- Download Formats

Select the right option to download the files on your device-

- CSV

- Online CSV

- Desktop TXF.

IRS Form 8949 TurboTax- Import TXF file

Go through these steps-

- Firstly, go to the Trade Bar option

- After that, click on the FY2008 folder

- Select the TXF exports from your context

- Choose your path & filename to save

- Then, tap Save to finalize the process

- Finally, locate the file on your saved path to open it.

Conclusion

Here is the guide to filling IRS form 8949 TurboTax. You can follow the methods mentioned above to resolve the issues generated in your TurboTax software. If you can not solve the TurboTax error codes, consult our experts for an effective solution. Wire IT Solutions offers software support and advanced accounting services for individuals and business owners.